Hostelworld PLC - Looking back on COVID recovery and strategy success

If there's an activity restless minds gravitate toward, it's travel. Over the past 20 years, international travel has gone from a hobby to a pastime; a rite of passage for Gen Y and Z. The privilege of globetrotting replacing mortgages.

Propelled by budget airlines like Ryanair (Europe) and Flybondi (South America), one can hop between countries for the price of a mediocre meal. Globalisation manifest, budget airlines' societal impact is huge: contributing to cultural integration but also excessive consumption and mass tourism.

Meanwhile, as [Michael] O’Leary [Ryanair CEO] puts it, “Ryanair has done more for European integration than vast waves of European bureaucracy.” The company and its competitors are arguably the greatest facilitators of the free movement of people, one of the foundational pillars on which the EU was built. Ryanair flies Belgian vacationers to Barcelona and Spanish students to Sweden. Its low prices allow a Polish worker to board a flight and relocate to France — and to book another to return home for the holidays.

(Politico.eu, 2016)

When directionless, “solo travel; find yourself” is a 21st century prescription. It’s becoming increasingly normal to do so: 1 in 5 millennials in the UK has taken a solo trip. Surging independent travel is taking the r/solotravel subculture mainstream. Hostels, a staple of frugal backpacking, exemplify this as 'poshtels' (posh hostels) surge in popularity - a hotel with solo travel vibes ✌️

If hostels are where most backpackers stay, hostelworld.com is the app.

Background

When I wrote about Hostelworld in 2020 (HSW LN Equity), my interest was a consequence of its low valuation against seemingly low odds of a COVID-19 default, given a strong balance sheet and limited cash burn.

Five years on, its stock has roughly doubled to a market cap of ~£150M.

Despite liking the trends, I was hesitant because HSW has a limited competitive moat against Booking.com, its closest and fiercest competitor.

However, its 2018 strategic turnaround plan is beginning to bear fruit. A renewed focus on improving its offering to hostels (e.g. backing a company marketing smart -enabled door locks: GOKI) and travellers (e.g. overhauling the mobile app with new social features) has markedly improved engagement and sentiment towards the brand - indicated during scuttlebutt conversations and financially.

Therefore, I think it's time to revisit HSW, as a longer-term play.

1 Reflections on 2020 views 🪞

Summarising my previous article with still-relevant points:

HSW faced concerns around competitiveness which COVID expounded, causing its valuation to fall to a trailing P/E of 4x.

Investors grew frustrated with limited progress and dividend cancellations.

- Hostel travel is expected to grow 6.5% annually - a tailwind for HSW.

Yet, there's intense competition from scaled OTAs like Booking Holdings ("BKNG"). This is significant because switching costs are low, elevated by hostellers' penchant for frugality. Many browse using Hostelworld but book direct to save money.

Nonetheless, HSW is financially robust, with no debt and healthy cash reserves. Financing will inevitably be required, but this isn't problematic.

TL;DR: Our main concerns were competition and ability to execute.

For travellers, Hostelworld has better hostel inventory, but it’s not a factor of material differentiation. Moreover, when reading travel forums it was clear customers that should be die hard fans of Hostelworld were not.

🟢 Yet, there’s growing evidence of improving user satisfaction!

For hostels, Hostelworld does have history in hostel management services: it was one of the first! Yet, in 2020 there was limited thus-far successful execution.

🟢 Anecdotally, Hostelworld is seen more favourably among hostel operators.

2 Hostelworld today 👋

HSW released FY25 results on 20/03/2025 and marked a full recovery from any COVID-19 overhang. On 29/04/2025, HSW also presented their Capital Markets Day ("CMD"), which we will write about at a later date. From FY25 results, developments can be grouped as follows:

Returning Customers account for an increasingly larger proportion of bookings, reducing customer acquisition costs ("CAC") via marketing expenses.

Margin Recovery as adjusted EBITDA margin reaches 24% following cost cuts.

Cashflow Recovery with a €14.3M swing into a net cash position, following fully paying down non-government debt.

Taken together these developments indicate that Hostelworld is:

growing bookings at 6-8%...

with a lean business model and limited outgoing liabilities...

generating free cash flow ("FCF") margins at ~15%.

2.1 Repeat customers

Hostelworld's big new feature is 'Social': a messenger for travellers to chat with others concurrently visiting the same hostel or city who also use Hostelworld. Solo travel is often very social, so Social solves a big problem and has been very popular (80% of those booking use Social).

This improves preference towards Hostelworld versus competitors. Given low switching costs (low prices and high inventory are expected), differentiation is crucial. Anecdotal chats with travellers during recent trips to Portugal and Argentina support this. Travellers rave about meeting others using Social.

Another positive about Social is large OTA competitors are unlikely to copy, because it compromises the cohesivity of their platform (offering hostels and homes in addition to hostels). Also, the TAM of hostels is probably too tiny to justify such a significant overhaul of, for example, Booking.com.

Whilst we agree Social is a competitive advantage, this network effect essentially resets after travellers’ trips end. A solution could be integrating nomads.com or nomadmania.com to keep connections alive between travels.

2.2 Margin recovery

In FY24, basic and adjusted EBITDA margins were ~22% and ~24%, respectively. Margins aresimilar to peers like BKNG (31%) and Airbnb (16%) however it's unlikely HSW reaches BKNG-level margins due to market dynamics, cancellations (~13% of gross revenues), and economic sensitivity.

For HSW, operating leverage is high. Risks to margins are:

Declines in take rate charged as a % of booking value (currently 15%).

Declines in booking volume. Up 6% year-over-year ("YoY").

Declines in average booking value ("ABV"). In FY24, this was -8% YoY, as travellers opted for cheaper locales like Vietnam and Thailand. This perhaps also highlights the economic sensitivity of backpackers (youth combined with long trips fosters stinginess!

Increases in operating costs. Down 2% YoY, as marketing costs and staff bonuses reduced.

2.3 Cash flow recovery

OTAs are asset light and cash generative.

HSW generated €20.6M Operating cash flow in FY24. Investing (€5.6M) and Financing (€14.0M) Activities led to a closing balance of €0.7M. A big chunk of Financing related to the repayment of debts to Allied Irish Banks (AIB). An outstanding loan from the Irish Government is all that remains, with €2.4M estimated to be paid in FY25.

We think HSW can end FY25 with > €15M (about 10% of its market cap).

Just quickly: at its recent CMD, HSW announced its FY25 dividend will be 20% of Net Income, so about 2.6 GBp per share (forward yield: 2.4%). Also, share buybacks will be considered as well as acquisitions. Given its current valuation, I'd prefer buybacks to dividends, however it's positive nonetheless as HSW historically hasn't done buybacks. Acquisitions are interesting, but my thoughts are limited currently.

3 Hostel economics 🏠️

Hostels as a commercial business is fairly new. Initially, ~100 years ago, hostels were free Christian Youth Hostels. Today, there's ~15,000 hostels worldwide with tens of millions of visitors annually. Hostels can be very profitable, with operating margins exceeding 30%, but many struggle financially. As the fortunes of HSW and hostels are linked, a discussion of the business of hostels is worthwhile.

At a glance…

Revenue: Hostel occupancy tends to be higher than hotels, but more seasonal.

Cost of Goods Sold ("COGS"): Hostels' minimal service means higher gross margins.

Gross margins: Around 60%.

Sales, general, and administration (SG&A) costs: Voluntary staffing lowers wage bills but high guest throughput means often higher maintenance costs.

Financing: Hostels, as small operations with seasonal turnover, often struggle to access debt - perpetuating their smaller scale relative to hotels.

3.1 Revenue

While per bed prices are lower than hotels, per room prices in hostels are often higher. In FY25, NBV observed by HSW was €46.41 in the US and €38.70 in Europe. When choosing accommodation, travellers decide between sought amenities and budget - content sacrificing some amenities (e.g. privacy) for savings (50%+).

For all accommodation providers, "per room" financials are an important measure.

Consider the above example. A hostel bed vs. hotel room is a ~60% saving for the traveller. Yet, a 4-bed room with 100% yields 64% more revenue per room! Kickass Greyfriars Edinburgh hostel has rooms with as many as 30 beds. Given those assumptions, that's £2,580 in one room! Such occupancy levels are unlikely: 60% occupancy is a rule-of-thumb for financial viability of hotels and hostels. In touristy cities like Edinburgh, hostels turnover is better than hotels if occupancy is > 75% (very achievable: a friend who ran a hotel said 85% is typical).

Location, location, location. Probably (unfortunately) more than review score, this is the driving force behind a hostel hitting good occupancy levels. Other notable revenue-centric KPIs for hostels are nightly rates and NBV relative to alternatives.

3.2 Costs

Little publicly available financial information on hostels' costs makes this section difficult, yet its components are well understood.

Key COGS are housekeeping supplies (e.g. cleaning products), linens (e.g. towels, pillowcases), toiletries (e.g. soap), and utilities (e.g. electricity).

Gross margins for hotels sit around ~60%. Ceteris paribus, hostels should be higher due to lower COGS per guest. Dormitory -style accommodation is basic, with additional costs in hotels like minibars or room service negated.

Hostels differ most in their operating costs, particularly staffing: often a hybrid model of paid and volunteer staff. Volunteers are usually backpackers, working in exchange for accommodation, meals, and generous time off to travel. This reduces payroll expenses and fosters the "hostel vibe" guests enjoy. In contrast, hotels rely on full-time or contract staff with standardised roles, wages, and benefits. This means operating cost per room is lower for hostels. Capital maintenance does tend to be higher for hostels due to more wear-and-tear.

This sounds great: hostels are financially leaner than hotels and make more money! Yet, if so why are there so few hostel at scale relative to hotels?

3.3 Financing

This explains the scale difference between hostels and hotels.

Turnover from tourism is highly seasonal, limiting consistent cash flows. When paired with fixed monthly rents or mortgage payments, debt financing becomes prohibitive and inaccessible. From anecdotal conversations with hostel owners, owning property is necessary for financial sustainability.

As an asset heavy business, financing is typically necessary for expansion. Hotels' turnover is less seasonal due to business travel (let me know if you ever see a McKinsey consultant in a hostel) and therefore expansion via financing is possible. However, this is changing. Large chain hostels have started to emerge, like Generator in Europe and Selina in resort-style destinations.

3.4 Takeaways for Hostelworld

Dealing with many independent hostels provides strong bargaining power to HSW. Yet, if the industry consolidates further, with chain hostels like Generator becoming more popular, this may reduce.

Hostels usually offer discounts to encourage guests to book directly. HSW must be comfortable with this dual reality. Ways of helping hostels with up-selling opportunities, like events, may encourage its inventory to be less directly combative.

4 How big is a niche and 10-tonne gorillas 🦍

Hostelworld is a minnow in a sea of whales. Let's be real. It shouldn't be able to compete in niche accommodation with the likes of Booking.com and Expedia. How they do it is worth considering.

A couple of questions:

How does Hostelworld hold off bigger OTAs?

What advantages (and disadvantages) does Hostelworld have versus others?

What would cause this situation to remain (change)?

4.1 Hostelworld vs. the rest of the hostel world 👊

HSW's success in carving out a niche, in my opinion, is as much an indication of larger OTAs relative weaknesses as HSW's strengths.

Hostelworld was founded in 1999; the flagship brand of Web Reservations International, who owned the brand until a founder buyout by PE firm Hellman & Friedman in 2009. The original go-to-market strategy was smart: offering reservation management software to hostels for free, which automatically linked to hostelworld.com, from which commission was charged per booking (same as today). The right place at the right (early internet) time, this strategy likely could have only worked because most hostels were (are) independent - as scaled OTAs would have no advantage in acquiring inventory.

Today's competitive landscape is different. Hostelworld acquired main rival Hostelbookers in 2013 and later retired it. This effectively eliminated direct competition, shifting competitive focus towards Booking.com. This strategy is sound, given the relatively small size of the hostel category. HSW reported €92M in Net Revenue in FY24. A reported 22% market share implies the market is less than €500M!

4.2 Strengths vs. scaled competitors 💪

Up against scaled competitors, HSW's strength is its focus on hostels.

Salespersons focused on acquiring hostel inventory. Direct relationships are important for small businesses. Poor communication from Booking.com is a frequent complaint of operators - more (it appears) than HSW, who has been expanding their acquisition/support team.

Product managers design for fewer segments. Being designed for hostel -goers only makes product integration easier. This may be a problem as HSW goes beyond hostels, as stated in their recent CMD.

A large company to champion and represent hostels. Events, like 'Hoscars', gives hostels avenues to market themselves. It may be small relative to competitors but, relative to its small market, Hostelworld is large (powerful too) when seen by hostels.

HSW's biggest weakness, in my view, remains its narrow moat. That may sound contrary given this article's positive stance. The moat has widened, but it's still narrow. Still, I'm more confident than before that market share won't decline.

4.3 Risks

Identifying risks to HSW's dominance is important to consider. Based on its own 'risk register', we identify key risks being "Macroeconomic conditions" and "Execution of strategy" whereas risks like "Financial" have lessened. Risks like "Data Security" and "Cyber Security" are difficult to comment on.

Macroeconomic conditions

Though beyond their control, a deterioration in the macro-economy is the where we see biggest downside risks. This has been exacerbated by recent US tariff-related uncertainty. The IMF has downgraded its 2025 growth forecasts to 2.8%, from an already tepid 3.3% - with reported bright spots in the USA (tariffs) and South East Asia offsetting gloomy outlooks in Europe (industrial weakness) and the Middle East (oil production cuts and conflicts).

"The global economy is set to expand at 3.1 percent five years from now—the lowest medium-term forecast in decades"

Considering this, early signs point to dampening appetite for leisure travel. HSW, operating in a highly discretionary sector (tourism) with an economically sensitive customer cohort (18-30 years old), would be hit hard.

Execution of strategy

I still question HSW's ability to execute - something I hope to discuss further when reviewing the recent CMD. This anxiety is probably a function of my lack of confidence in the moat and HSW, as B2C software, having to constantly change. Hostelworld.com is different to 5 years in the past - and future.

5 Valuing Hostelworld today 📈

5.1 Expectations

In 2024, HSW Net Bookings were 6.9M, generating €92M in revenue. By its own estimates, OTAs process ~50% of hostel bookings, where HSW's share is 22%. That implies an immediate (total) addressable market of less than €500M (€1B)!

The hostel market is growing at 6.5% annually. We think HSW is unlikely to take market share from competitors, despite its strengths in product and inventory. Large OTAs simply have more mindshare, especially among 'novice' backpackers because they've likely used them to book other accommodation types before ("I've used Booking.com for hotels, so why not hostels"). Therefore, onboarding hostels that don't advertise on OTAs is their best way to grow above the market - 10% growth is probably the upper limit. In the near term, this growth may be flat due to aforementioned macroeconomic risks.

Improving margins is the catalyst. There's little outstanding debt to repay. Net Cash in FY24 would've been €18.2M, excluding debt repayments. This, plus continual efficiency improvements in marketing, headcount, IT spend, causes me to believe in the possibility of 20% FCF margins.

The valuation of HSW appears cheap. Taking the above Net Cash adjustment would imply a 9x multiple. However, I think a re-rating is unlikely in the near term. Its valuation is relatively similar to peers - with BKNG being an outlier. A poor market outlook for 2025 may explain this.

5.2 Valuations

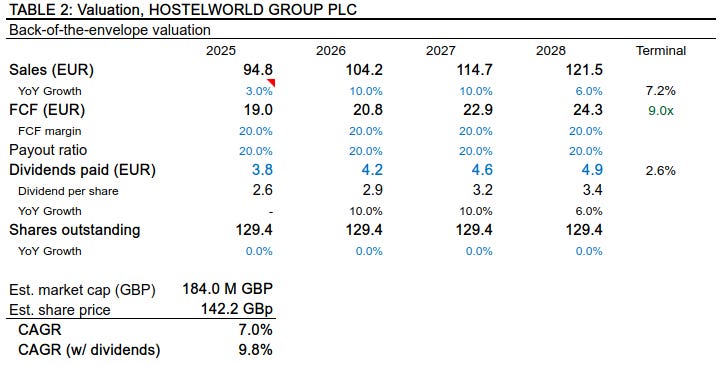

HSW guided in their recent CMD for low single digit revenue growth (3%) that, in my opinion, may still be too ambitious. Nevertheless, we're optimistic on higher FCF margins (20%). Using those assumptions with a 9x multiple gives €171M or £143M. Given today's market cap of ~£150M, I think further downside is limited.

Including dividends without any further uplift in payout ratio (20%) - historic payout ratios were as high as 75% - annualised returns of nearly 10% are possible, without any re-rating. At a 15x multiple, this increases to nearly 30% annualised.

Not much further commentary is required.

6 Concluding thoughts 🧠

In writing this article, I wanted to assess whether Hostelworld, the business, has materially improved and whether HSW LN Equity, the stock, interests me. On both accounts, I think "yes".

Hostelworld has recovered fully from the COVID-19 overhang and made significant strategic progress, notably with the success of Social improving engagegement, encouraging repeat bookings, and lowering CAC. Financial health has improved too, with the business set to swing into a net cash position and exhibiting strong cash flow generation and margin recovery.

While operating in a niche market worth less than €500M alongside formidable competition, Hostelworld's focus gives meaningful differentiation but its competitive moat remains narrow. In the face of macroeconomic risks, its valuation appears attractive relative to its improving financial performance and cash generation. Prospective dividends and buybacks suggest attractive annual returns are possible - without a significant re-rating.